PRUCredit Protector Plus

Why do you need PRUCredit Protector Plus?

While trying to achieve your life goals by getting supporting loan money from a bank to own a car, small and medium business, or new home, having a loan protection plan is better. Suppose an unfortunate thing may happen to you unexpectedly, such as unfortunate death or total and permanent disability. In that case, PRUCredit Protector Plus can help provide financial protection to you and your family that may help you pay off your loan and let your loved ones live a financially protected life.

How can we help you

PRUCredit Protector Plus – myCar

PRUCredit Protector – myHome

PRUCredit Protector Plus – mySME

Learn More

How you can maximize your protection based on your needs

| BASIC PLAN | EXTRA PLAN |

| Death or Total and permanent disability benefit due to any cause | |

| 100% of the sum assured payout | |

| 3.000.000 LAK on funeral benefit | |

| Additional Death or Total and permanent disability benefit due to an accident* | |

| x | 100% of the sum assured payout as Additional benefit in case of accidental death or total and permanent disability |

Case Study of PRUCredit Protector Plus

|

Mr. Khamphanh |

|

Please note that:

- The premium will depend on individual's condition, and the showing number is determined by Mr.Kamphanh's condition.

- The claim amount will be based on the initial schedule of benefit at the purchase and could be higher or lower than actual outstanding loan amount.

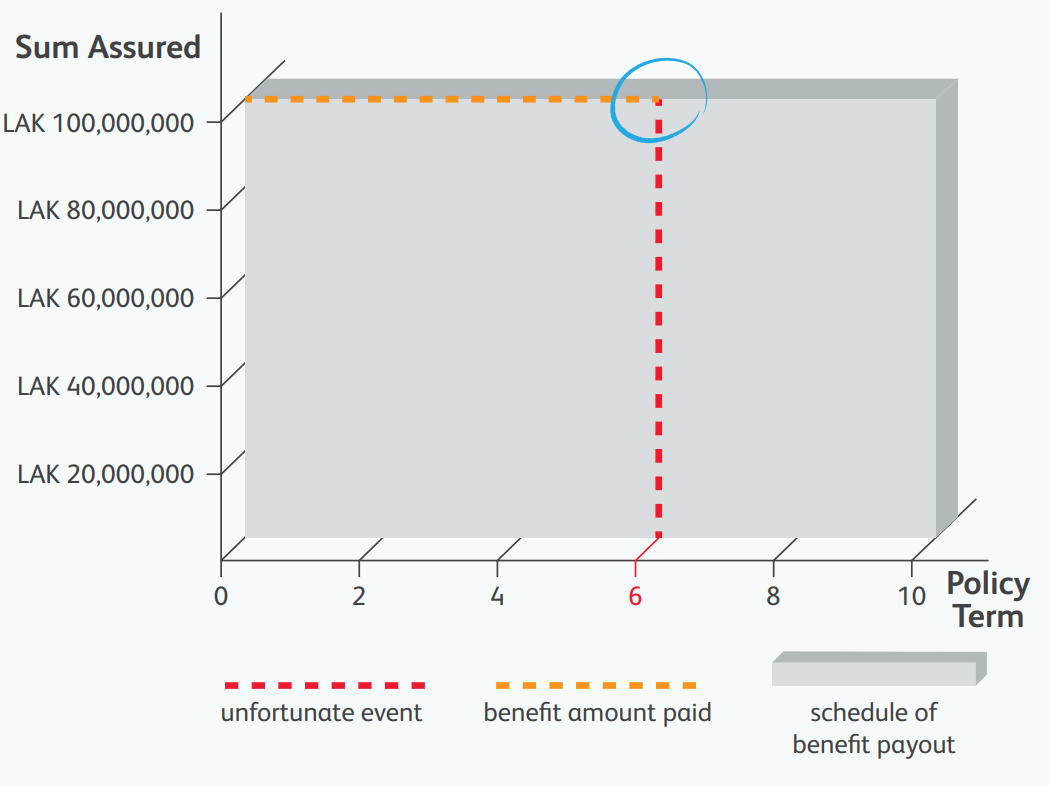

Scenario 1 Mr Khamphanh's beneficiaries will get the following if he gets a Level Term Insurance:

|

Benefits | Simple Plan | Extra Plan |

| Let's assume that the outstanding bank loan on the 6th year is 70.000.000 LAK | |||

|

In case of Death or Total and Permanent Disability (TPD) Benefit from all causes |

The 1st Beneficiary of the Policy will receive: 70.000.000 LAK The 2nd Beneficiary of the Policy will receive any excess amount from the scheduled benefit payout: 30.000.000 LAK The 2nd Beneficiary of the Policy will receive a Funeral Benefit: 3.000.000 LAK

|

The 1st Beneficiary of the Policy will receive: 70.000.000 LAK The 2nd Beneficiary of the Policy will receive any excess amount from the scheduled benefit payout: 30.000.000 LAK The 2nd Beneficiary will receive: Funeral Benefit: 3.000.000 LAK |

|

|

In case of Accidental Death or Accidental Total and Permanent Disability Benefit |

Only for an Extra Plan, the 2nd Beneficiary will receive: 100.000.000 LAK |

||

|

The 1st Beneficiary could receive is up to |

70.000.000 LAK |

||

|

The 2nd Beneficiary could receive is up to |

33.000.000 LAK |

133.000.000 LAK (Inclusive of accidental benefit and funeral benefit) | |

|

Total Benefit is up to |

103.000.000 LAK |

203.000.000 LAK | |

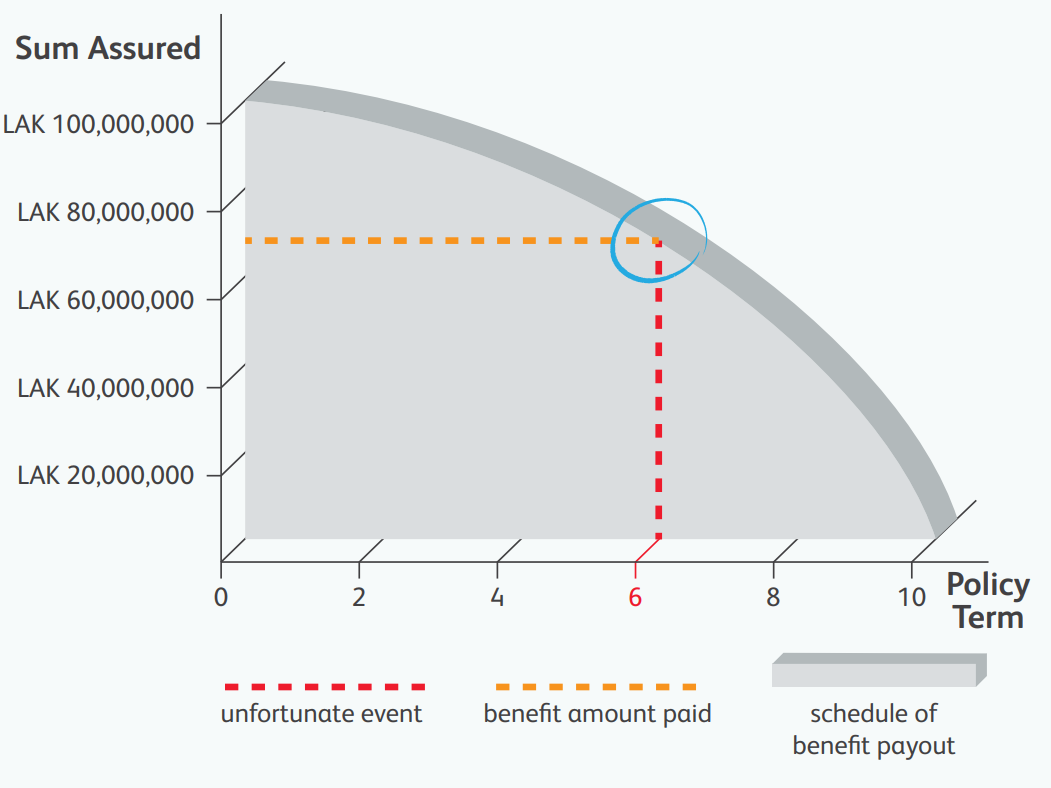

Scenario 2 Mr Khamphanh's beneficiaries will get the following if he gets a Reducing Term Insurance:

|

Benefits | Simple Plan | Extra Plan |

| Let's assume that the outstanding bank loan on the 6th year is 70.000.000 LAK | |||

|

In case of Death or Total and Permanent Disability (TPD) Benefit from all causes |

The 1st Beneficiary of the Policy will receive: 70.000.000 LAK The 2nd Beneficiary of the Policy will receive a Funeral Benefit: 3.000.000 LAK

|

The 1st Beneficiary of the Policy will receive: 70.000.000 LAK The 2nd Beneficiary will receive: Funeral Benefit: 3.000.000 LAK |

|

|

In case of Accidental Death or Accidental Total and Permanent Disability Benefit |

Only for an Extra Plan, the 2nd Beneficiary will receive: 70.000.000 LAK |

||

|

The 1st Beneficiary could receive is up to |

70.000.000 LAK

|

||

|

The 2nd Beneficiary could receive is up to |

3.000.000 LAK |

73.000.000 LAK (Inclusive of accidental benefit and funeral benefit) | |

|

Total Benefit is up to |

73.000.000 LAK |

143.000.000 LAK | |

Important Note:

- Additional Death and Total and Permanent Disability Benefits due to an accident are optional and can be opted out.

- The maturity benefit is not eligible for the product.

- You can choose the type of coverage, either Reducing term assurance or Level term assurance.

- You may cancel the policy within thirty (30) days (Free-Look period) from the day you received a Policy Kit.

The Surrender value is payable to you upon surrender anytime during the policy term. The payable amount is shown in the - Prudential's Scheduled of Benefit Illustration (However, early surrender is not in

the customer's best interests). - Suicide, HIV, committing a crime, using illegal drugs, drinking alcohol and having pre-existing conditions are among the major exclusions.

- We suggest you discuss with a Prudential Financial consultant for the best advice based on your needs. The informations stated in this website are non-exhaustive. For more detail, kindly refer to the Terms and Conditions.