PRUCredit Protector

Product Features

200% Accidental benefits

Funeral fees benefits

Insurable types of loan

How can we Help you

PRUCredit Protector is a type of insurance that helps pay off your outstanding loan balance to the bank up to the sum assured selected, in case of loss of life or total permanent disability.

It is designed not only to pay off your outstanding debt but also to protect your family or beneficiary from any unexpected financial worry.

Learn More

Case Study of PRUCredit Protector

Mr. Khamchan is 35 years old, married and works as a farmer. Decided to take a loan from the bank to invest in a pig farm.

He decided to buy PRUCredit Protector with following features: Bank loan amount is LAK 80.000.000 with a policy term of 5 years.

Premium that Mr.Khamchan pays:

| Payment Method | Single Payment |

| Premium | LAK 2.170.000 |

Benefits on Death & Total Permanent Disability due to accident

3 years after, Mr.Khamchan passed away due to an unfortunate accident leaving behind a loan amount of LAK 36.816.000

- Sum Assured of pending loan amount LAK 36.816.000 will be paid to the bank

- Sum Assured of pending loan amount LAK 36.816.000 will be paid to the family

- Funeral Benefit of LAK 10.000.000 will be paid to the family

Frequently asked questions about PRUCredit Protector

| Why is PRUCredit Protector the right product for me? | PRUCredit Protector is an appropriate product for customers who have taken any type of loan. The product will protect you from passing on the burden of loan repayment on your family in the unfortunate event of death or total permanent disability. |

| Can I buy PRUCredit Protector for only some part of the loan? | The insurance cover must be the same amount as the loan. |

| Can the borrower have more than one loan? | Yes, the borrower can take more than one loan from the bank and Prudential will provide different insurance covers for the respective amounts subject to the maximum sum assured per life. |

| Does a member need to undergo any medical underwriting? | No, it is simplified underwriting with approximately 3-5 questions being asked. |

| In case of a claim, who will the claim be paid to? | The primary beneficiary will be the bank. The secondary beneficiary will be the family of life insured. |

| Can I surrender the policy during the policy term? | Yes, the policy can be surrendered by the policy owner but this means you will lose your insurance protection if the loan is not yet fully repaid. |

| What would be the payout on surrender? | A cash amount called Surrender Benefit will be paid based on the policy term and policy year in which the policy is surrendered. Surrendering a policy early may not be beneficial for customer. |

| Can I cancel the policy immediately post purchase? | Yes, the policy has a freelook period which allows the customer to cancel the policy within 30 days from the date of receiving policy. |

| Is the product renewable? | No, the product is a single premium product and not applicable for renewal. |

| What are the exclusions of the product? | The policy has a few exclusions like suicide or attempted suicide within the first 2 years of the policy, HIV includes AIDS, committing a criminal offense, drugs, abusively using alcohol, etc. For a detailed list, please refer to the Terms and Conditions document. |

Important notes

Criteria of the Beneficiaries / Person to Receive Claim Payment

The Primary Beneficiary under this product is the Financial Institution. The Policy Owner may nominate Secondary Beneficiary/Beneficiaries when filling the Insurance Application Form. The Secondary Beneficiary will only be eligible to receive an amount by which the Death or TPD benefit at the time of claim based on the amount specified in Prudential’s Benefit Illustration exceeds the outstanding loan amount.

While this Policy is in effect and during the lifetime of the Life Assured, they may change the Secondary Beneficiary with respect to the Policy by filing a written request with us Prudential, while this Policy is in effect. The revised conditions shall come into effect upon the Company issuing its written approval of the modifications and shall constitute a formal and legal part of the Policy.

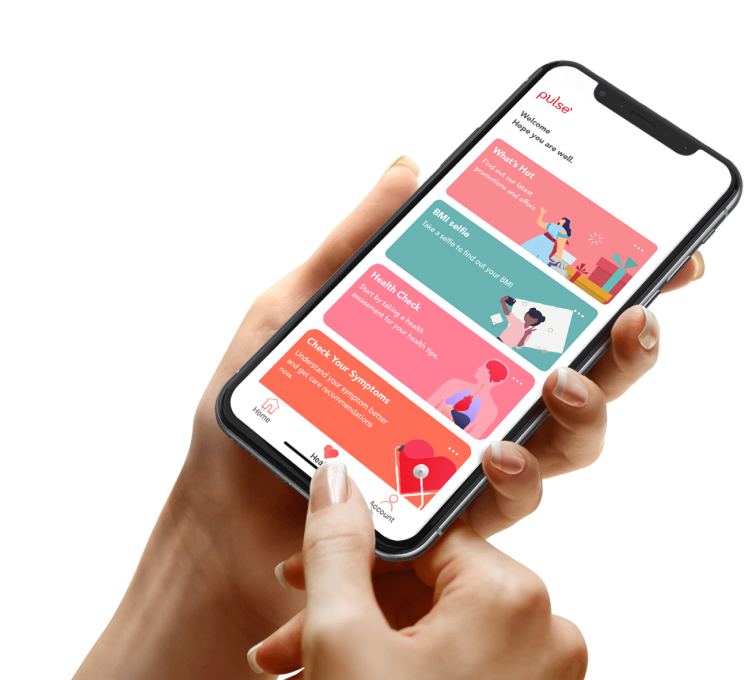

Personal health insight with Pulse