PRUCritical Care+ and PRUPremium Waiver

Why do you need PRUCritical Care+ & PRUPremium Waiver

Live the best life without financial burden, even if there is an unfortunate critical illness that may happen to you while you are chasing your life goals. PRUCritical Care+ and PRUPremium Waiver will help you secure your financial future against uncertainty.

Introducing PRUCritical Care+ & PRUPremium Waiver, the comprehensive solution safeguards your financial well-being while prioritizing your life goals, protecting you from the unforeseen.

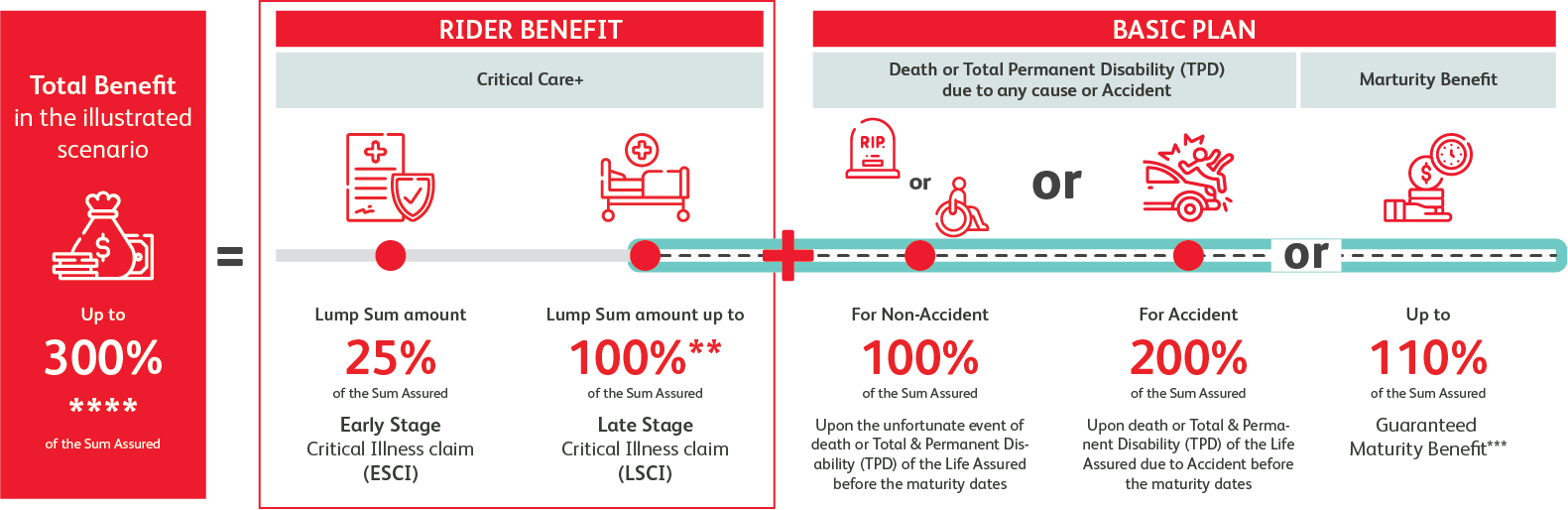

With coverage for 50 critical illness conditions of specific severity, you can rest assured knowing that financially, you are secure. In the event of an Early-Stage Critical Illness (ESCI), PRUCritical Care+ others 25% of the Sum Assured as a lump sum amount and is paid immediately upon claim. Similarly, for Late-Stage Critical Illness (LSCI), you can count on PRUCritical Care+ for prompt financial support on a lump sum amount up to 100%** of the Sum Assured.

To further ease your financial burden, with the PRUPremium Waiver, you can be exempted in paying your future insurance payments (premiums) upon diagnosis of the 25 Late-Stage Critical Illness conditions. With PRUCritical Care+ & PRUPremium Waiver, you can focus on your life goals and well-being without worrying about the financial burden of critical illnesses. Take control of your future and secure your financial stability today.

Available for ages 18-60 and payment period options from 5 years to 15 years*.

Product benefits at a glance

Let's explore how this solution* can benefit you and your loved ones.

The following illustration assumes the Sum Assured of the basic plan combined with the PRUCritical Care+ & PRUPremium Waiver.

Important Notes:

|

* |

Subject to basic plan limits and product conditions. |

| ** | If you have already received a 25% payout at an earlier stage critical illness claim, the remaining balance from the total claim amount will be paid as a late-stage payment. |

| *** | The Maturity Benefit, a lump-sum amount paid after the maturity of the insurance policy if no unfortunate events occur, is subject to the Policy being in force on the Maturity Date, which marks the end of the insurance coverage term (Policy Term). The actual payout may vary based on the chosen Basic Plan product and Policy Term because the Maturity Benefit is solely based on the Basic Plan, the Premium Paid for the Basic + Rider may be greater than the Maturity Benefit. |

| **** | Basic plan coverage for Death or Total and Permanent Disability (TPD) including PRUCritical Care+ & PRUPremium Waiver rider benefit provides up to 200% non-accidental benefit or up to 300% accidental benefit. |

| ----- | No additional insurance premium is required under your Policy with PRUPremium Waiver Rider upon a certain critical illness late-stage conditions diagnosis. |

Learn More

Case Study

|

30 years old man |

Sum Assured for basic plan (PRULife Saver Plus) LAK 60.000.000 |

Coverage Period 10 years |

|

Mr. Sith |

Bought one of the basic life insurance plans from Prudential Laos, PruLife Save Plus (Regular payment mode) with rider benefits called PRUCritical Care+ & PRUPremium Waiver. |

Sum Assured rider benefit (PRUCriticalCare+ & PRUPremium Waiver) LAK 60.000.000 |

Insurance payment (premium) mode Annually |

|

Premium that Mr. Sith pays |

Initial annual insurance payment (premium) for basic plan (PRULife Saver Plus) = LAK 3,053,500

Initial annual insurance payment (premium) for rider benefit, PRUCritical Care+ and PRUPremium Waiver plan = LAK 207,500*

Total initial annual insurance payment (premium) = LAK 3,261,000

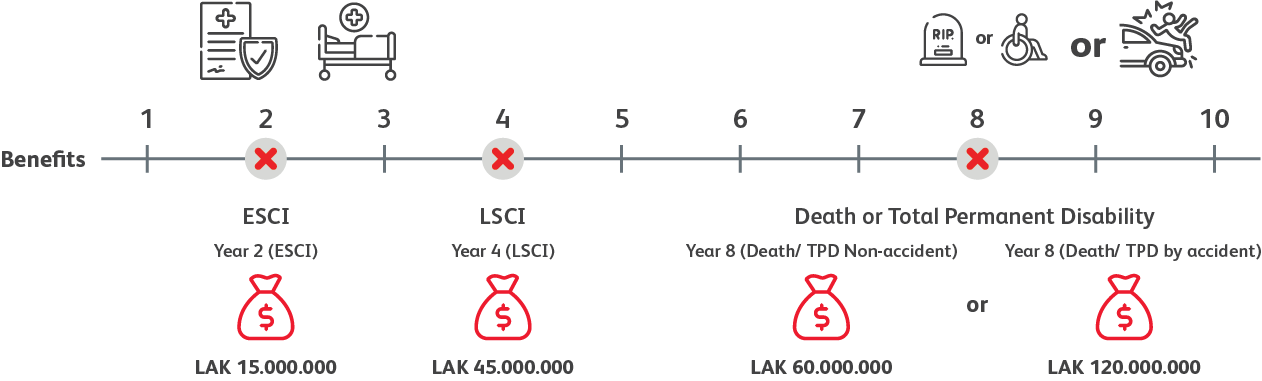

In the case that Mr. Sith was diagnosed with ESCI in Year 2 and LSCI in Year 4. Unfortunately, he passed away in Year 8

*Premium for PRUCritical Care+ and PRUPremium Waiver riders are non-guaranteed.

|

Insurance payment (premium) (basic plan PRULife Saver Plus + rider benefit PRUCritical Care+ & PRUPremium Waiver) |

|

After Year 4, no further insurance payment (premium) is payable under Mr.Sith’s policy due to the PRUPremium Waiver rider benefit being attached, as he is diagnosed with Late-Stage Critical Illness. In the event that the customer is diagnosed with Late-Stage Critical Illness (LSCI) in Year 4 or or later, the Basic Plan continues to provide coverage for Death and Total Permanent Disability, and Maturity Benefits.

Year 1 - Year 4 insurance payment (premium)

|

Basic plan

LAK 12.214.000 |

+ |

CI and WOP plan

LAK 830.000 |

= |

Total premium paid

LAK 13.044.000 |

| Benefits for Mr.Sith |

|

Total Benefits |

||

|

LAK 15.000.000 + LAK 45.000.000 + LAK 60.000.000 LAK 120.000.000 (In case of Non-accident) |

LAK 15.000.000 + LAK 45.000.000 + LAK 120.000.000 LAK 120.000.000 (In case of accident) |

After Year 4 until Year 8 LAK 12.214.000 of Insurance payment (premium) is waived under Mr.Sith's Basic Plan |

Important Notes: The insurance payment (premium) will vary depending on individual conditions, and the specific amount will be determined based on Mr. Sith's condition. The claim amount will be determined based on the initial schedule of benefits at the time of purchase. You can choose and get the PRUCritical Care+ & PRUPremium Waiver (rider benefit) to life insurance plan (basic plan) from Prudential Laos based on your specific needs. The terms and conditions stated in this brochure are non-exhaustive. For more information, please refer to the detailed product terms and conditions.

Frequently asked questions

|

What is PRUCritical Care+? |

This product is an additional Critical illness rider, covering 25 Early-stage critical illnesses (ESCI) conditions and 25 Late-stage critical illnesses (LSCI) conditions that attached to your Basic Plan product. |

|

What is PRUPremium Waiver? |

This rider would provide waiver 100% of All future Installment Premium Payable of the attached products, in the event of the Insured is diagnosed to be suffering from 25 Late-stage critical illnesses (LSCI) conditions as defined on the Critical Illness Table and can be attached to your Basic Plan product. Please see the product terms and conditions for Critical Illness Table. |

|

Who is eligible to purchase PRUCritical Care+ and PRUPremium Waiver? |

You may purchase this product if you are:

residential address in the country;

|

|

What is the Entry Age for Life Assured? |

18-60 years old. |

|

What are the key exclusions of PRUCritical Care+ and PRUPremium Waiver? |

In cases of critical illness conditions due to an accident, this waiting period does not apply. |

|

In what timeframe must I register a claim? |

Claim must be made within 6 months of the occurrence of the critical illness event and while the life assured is alive. |

|

What are the documents required when submitting a claim? |

For claims, proof of occurrence must be supported by:

|

|

Can I cancel my Rider? |

You may cancel your Rider at any time during the policy term. However, there is no premium refund applicable after the Freelook period of 30 days from the date that the Policy Owner has signed the acknowledgement letter or the receipt of policy kit. |

|

Under what other circumstances will my policy terminate? |

Please see the policy terms and conditions for a full list of instances under which the policy will be terminated. |