PRULife Starter

Product Benefits

Affordable and easy to buy

Basic benefit plan

Double benefit plan (Basic + Rider plan)

Affordable and easy-to-access plans

PRULife Starter is a one-year term life insurance plan that provides protection against financial burden should death, total and permanent disability or accident occur. With PRULife Starter, your family is financially secure with protection coverage in case of an unfortunate incident happens to you. Get PRULife Starter to kick start the protected life now.

Learn More

Case Study of PRULife Starter

- Mr. Phonexay/ 32 years old. male

- Recently married

- Considering a PRULife Starter policy. 1-year life insurance protection plan.

|

|

Permanent Disability due to a Natural cause |

Death or Total and |

Death or Total and |

| Basic Benefit Plan (Basic) |

5,000,000 LAK coverage |

5,000,000 LAK coverage |

5,000,000 LAK coverage |

| Double Benefit Plan (Basic + Rider) – Bronze Plan |

5,000,000 LAK coverage |

10,000,000 LAK coverage |

7,500,000 LAK coverage |

Frequently asked questions about PRULife Starter

|

Q: Will I immediately get 1 year coverage after my policy is issued? |

A: In order to ensure the benefit of the customer, Prudential Life Assurance (Lao) Company Limited has the right to request additional documents within 5 working days of the date of the application if necessary for onboarding the customer or if Prudential Life Assurance (Lao) Company Limited determine that the provided document is insufficient. If the requesting document cannot be provided within 7 calendar days, Prudential Life Assurance (Lao) Company Limited has the right to reject the application and return the premium. The claim's turnaround time and even the claim request's rejection will be affected by the lack of supporting documentation. |

|

Q: What will happen if my registration verification result is unsuccessful? |

A: We will contact you to notify on the reason and the next process. If we are unable to reach out to you within 7 calendar days, we will send notification SMS and proceed to refund. In this case, we will release all responsibility of insurance coverage. |

|

Q: Can a Non-Lao citizen purchase PRULife Starter? |

A: Yes, for Non-Lao Citizen, you should submit a valid of Residence Permit/ Work Permit/ Business Visa (Valid for at least 6 months) |

|

Q: Is it possible to purchase PRULife Starter for my spouse/family? |

A: Yes, by using your spouse/family’s phone number to register and create a PRUShoppee account, providing their full names, contact details, and proof of identity. Then, with their permission by the OTP which will be sent to their mobile number, they can use their account to purchase this product. |

|

Q: Is it possible to change beneficiary during the covering year? |

A: Yes, by going to PRUShoppe, filling out the form, and proceeding with the steps. |

|

Q: Can premium be changed in the policy renewal year? |

A: The premium will be taken into consideration during the renewal year. According on the bundle you choose. |

|

Q: In case I have no claim during the contract period, I will receive premium that I paid in policy or get some discount for renewal year? |

A: No, there is no return amount according to the term and conditions of this product and there is no discount as well. |

Importance notes

*The lowest insurance payment (premium amount) is at 205 KIP/Day for 18 -30 years old; basic benefit, bronze plan, and PRULife Starter can buy at annual mode only. The insurance payment (premium amount) may vary based on age band, gender, and plan.

**In the event of an accident that results in Death, total and permanent disability of the Life Assured occurring while the Life Assured is riding or travelling by motorcycle during the insurance coverage period (policy term), the Company shall pay to the Beneficiary half of the double benefits plan (Basic +Rider) Sum Assured.

***The insurance payment is inclusive of the registration fee on the plan that you have chosen. The Freelook period, during which you can decide to terminate the plan and get a refund, will be 7 days from the acceptance of the life insurance plan. The insurance coverage is a one-year term plan and is not guaranteed renewable. All the payments shown in this webpage are in Lao KIP. The terms and conditions stated in this brochure are non-exhaustive. Please refer to the exact terms and conditions, specific details, and exclusions applicable to these insurance products in the insurance policy contract.

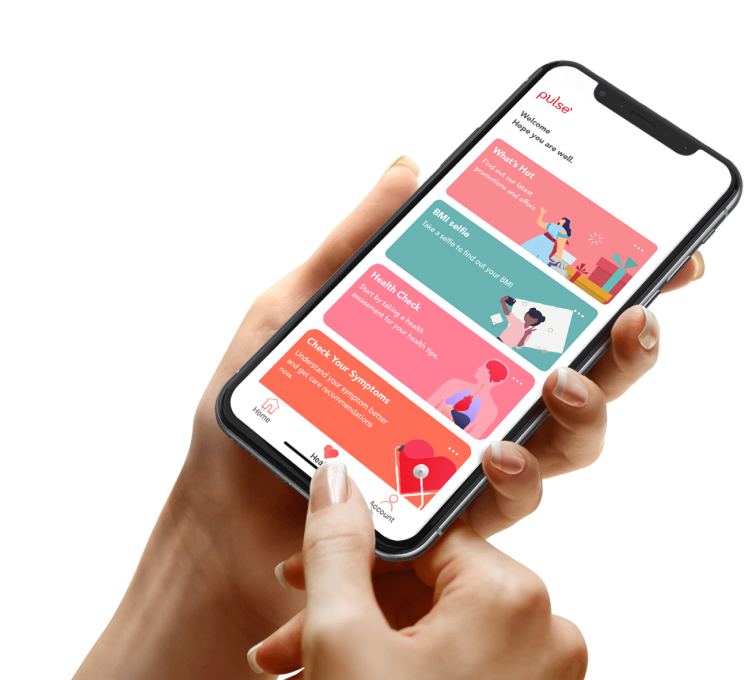

Personal health insights with Pulse