PRUBusiness

Product Benefits

Term Life Basic

Accidental Death and Disablement Benefit Rider (GADD)

Accidental Hospital Income Benefit Rider (AHIB)

How we can help you

Improving employee satisfaction is a high priority

There is an economic link between employee satisfaction and company financial performance; happy workplace culture leads to higher employee productivity.

Employees are the most valuable asset for any organization. Offering insurance protection to employees as a part of the benefits package will lead to a happier and a healthier workforce which will in turn lead to more productive employees.

Learn More

PRUBusiness Packages

| Term Life Basic Plan (GTL) (1) | Accidental Death and Disablement Rider (GADD)(1) | Accidental Hospital Income Benefit Rider (GAHIB) (1) | |

| Plan 1 | 50,000,000LAK | 50,000,000LAK | 50,000LAK |

| Plan 2 | 100,000,000LAK | 100,000,000LAK | 100,000LAK |

| Plan 3 | 150,000,000LAK | 150,000,000LAK | 150,000LAK |

| Plan 4 | 200,000,000LAK | 200,000,000LAK | 200,000LAK |

| Plan 5 | Customization | Customization | Customization |

1) GTL is compulsory, and GADD and GAHIB are optional riders which could be attached as per the company’s requirements. Please note the decision to opt for riders is to be taken at master policy level.

2) Coverage levels can be customized as per the company’s requirements as per the internal standards of the company.

Frequently asked questions about PRUBusiness

- Who is eligible for PRUBusiness?

All employees directors, partners and proprietors who are engaged in any full-time occupation or work for remuneration or profit under a contract of employment are eligible for this plan. Only legal foreign workers (with valid Laos working permit) are accepted.

- Does a member need to undergo any medical underwriting?

Members do not need to undergo any medicals for cover levels up to the Free Cover Limit. Free Cover Limit is dependent on the policy sum assured and the group size. For a policy sum assured and the group size. For a policy where the number of members is less than 100, the members are required to answer the Personal Statement questionnaire to undergo medical underwriting.

- Will employees who join during the policy term be covered?

Yes, employees who join the company during the policy year, will be covered under the policy. The company will need to pay pro-rata premium for the policy. In case an employee leaves the organization (and has not made a claim on the policy or the attached rider), Prudential will refund the pro-rata premium to the company.

- In case of a claim, who will the claim be paid to?

In case of a claim, the payment will be paid to the beneficiary as chosen by the employee.

- Can I surrender the policy during the policy term?

Yes, you can surrender the policy. In case no claim has been made on the policy (base policy or rider), we will refund the pro-rata premium.

Important notes

| Employee Eligibility |

Full time employees only and who are in an ‘Actively at work condition’ A person is considered actively at work if they are in active service of employment, have no physical disability, are not on leave due to sickness and have not been on leave due to sickness for five or more continuous days during the last one year prior policy commencement. Physical disability is defined as loss or fracture of a limb or loss of sight or hearing on at least on eye or ear, respectively. |

| Minimum Number of Employees |

5, however if number of employees are less than 10, they will only be covered subject to full underwriting. Coverage will also be available for employee’s spouse |

| Minimum and Maximum Entry Age |

Group Member: 18 – 65 years or normal retirement age. Beyond age 65 years or normal retirement age, the members will be covered subject to underwriting. Cover ceasing age is 66 years. Coverage is also available to member’s spouse with entry age between 18 – 65 years. Coverage for the spouse will cease at age 66 years. |

| Policy Term | 1 year; yearly renewable |

| Policy Benefit | 100% of policy sum assured in case of death or total and permanent disability whichever occurs earlier. |

Interested in PRUBusiness?

For more information on group insurance, please contact +856 2055 858 393

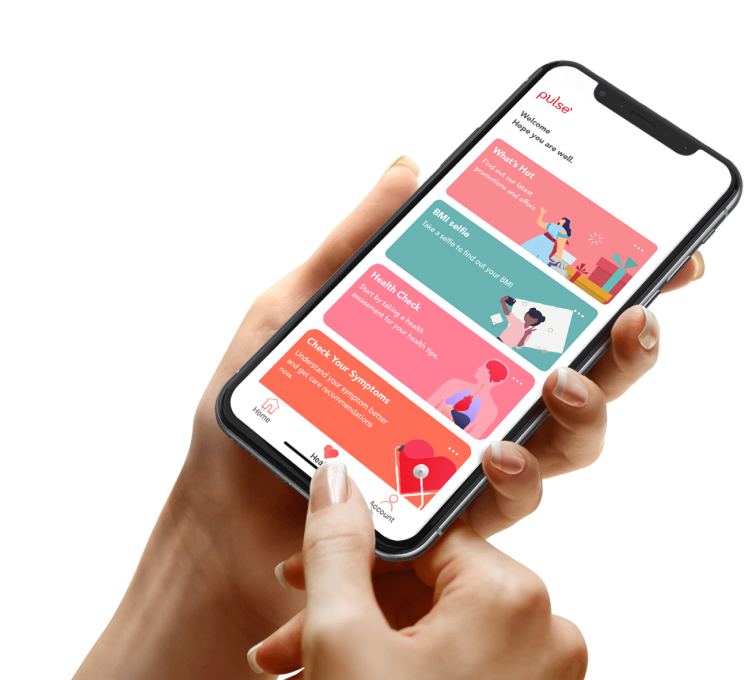

Personal health insights with Pulse